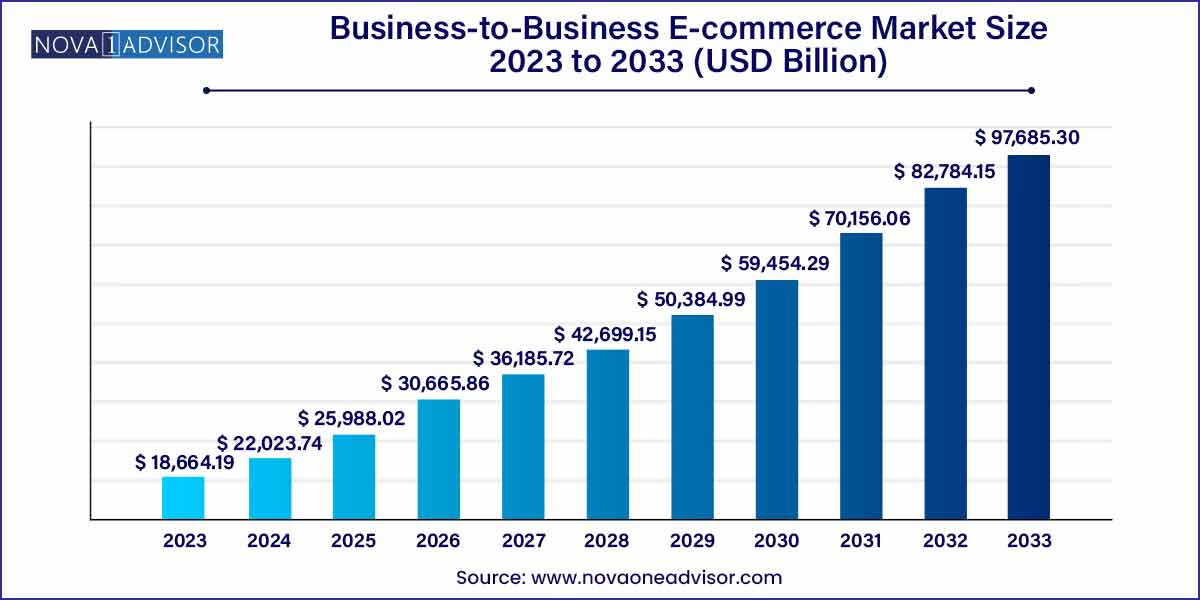

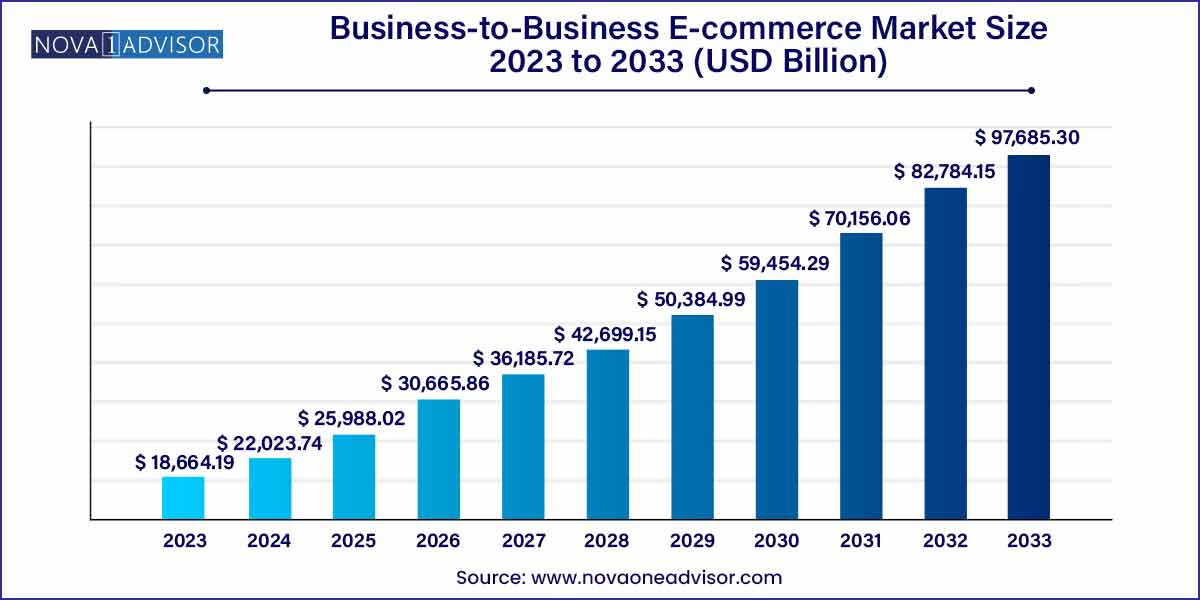

The global business-to-business E-commerce market size was estimated at USD 18,664.19 billion in 2023 and is projected to hit around USD 97,685.30 billion by 2033, growing at a CAGR of 18% during the forecast period from 2024 to 2033.

Key Takeaways:

- North America dominated the market and accounted for around 40.8% share in 2023.

- Asia Pacific is anticipated to witness significant growth in the market. Asia Pacific is one of the fastest-growing markets for B2B e-commerce management.

- Home & kitchen segment accounted for the largest market share around 22.9% in 2023.

- The intermediary-oriented segment accounted for the largest market share, around 60.21%, in 2023.

Market Overview

The Business-to-Business (B2B) E-commerce Market represents one of the most transformative forces in global trade, streamlining the procurement process between businesses through digital platforms. Unlike business-to-consumer (B2C) models, B2B e-commerce involves larger volumes, bulk purchasing, customized pricing, complex negotiations, and integrated fulfillment services all of which are now being digitized.

In recent years, B2B e-commerce has transitioned from static product catalogues and email-based orders to dynamic, AI-enhanced platforms offering personalized pricing, automated reordering, and real-time inventory management. The COVID-19 pandemic significantly accelerated this shift, as businesses were forced to digitize their procurement and sales pipelines. As a result, both traditional manufacturers and wholesale distributors have adopted or built e-commerce capabilities, creating a digital-first marketplace ecosystem.

The global B2B e-commerce market encompasses supplier-oriented, buyer-oriented, and intermediary-oriented platforms. Alibaba, Amazon Business, ThomasNet, and industry-specific portals have created digital bridges between millions of buyers and sellers across industries ranging from industrial parts to healthcare equipment and fashion textiles.

Fueled by the proliferation of cloud computing, mobile commerce, and ERP-integrated platforms, the B2B e-commerce market is projected to grow steadily over the coming years. Businesses are no longer satisfied with manual, error-prone procurement systems. Instead, they demand seamless, intelligent, and secure B2B buying experiences akin to the B2C world but tailored for their scale and complexity.

Major Trends in the Market

-

Rise of Mobile B2B Commerce: Procurement managers are increasingly using mobile apps for inventory tracking, reorders, and product comparison on the go.

-

Integration of AI & Personalization Engines: Machine learning is enabling personalized pricing, automated recommendations, and smart catalog management.

-

ERP and CRM Integration: Seamless integration with internal systems ensures smoother order management, invoicing, and inventory syncing.

-

Voice and Conversational Commerce: Voice-enabled ordering and chatbot-based reordering are gaining traction in large warehouses and small businesses alike.

-

Sustainable B2B Practices: Suppliers with sustainability certifications and carbon-neutral shipping are becoming more attractive to enterprise buyers.

-

Rise of Marketplace Platforms: Vertical marketplaces like Faire (for retail), ThomasNet (for industrial), and HealthProcure (for medical supplies) are dominating niche segments.

-

Blockchain for Traceability and Smart Contracts: Blockchain-enabled platforms are being explored to ensure transparency and automate contractual obligations.

Business-to-Business E-commerce Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 22,023.74 Billion |

| Market Size by 2033 |

USD 97,685.30 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 18% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Product category, deployment, region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Amazon.com, Inc.; Alibaba.com; ASOS; Costco Wholesale Corporation; Dangdang; eBay Inc.; Flipkart.com; JD.com; Lazada; MercadoLibre S.R.L.; Shopify; Shopee; Walmart; Wayfair LLC; Zalando |

The key driver of the B2B e-commerce market is the rapid digital transformation of global supply chains, spurred by competitive pressure, demand for operational efficiency, and the evolving expectations of B2B buyers. Businesses are seeking ways to reduce costs, improve order accuracy, and speed up fulfillment goals that digital platforms are well-equipped to achieve.

Historically, B2B procurement involved layers of manual paperwork, sales calls, and in-person negotiations. With digital procurement portals, businesses can now compare prices, manage suppliers, track deliveries, and issue invoices with just a few clicks. This transformation is particularly critical in sectors such as manufacturing, where downtime can cost thousands of dollars per hour, and timely procurement is mission-critical.

Additionally, buyers increasingly expect the same user experience they enjoy in B2C: intuitive navigation, real-time availability, order history, and personalized pricing. The need to meet these expectations, combined with the economic advantages of automation, is accelerating the adoption of B2B e-commerce across verticals.

Key Market Restraint: Complex Pricing and Customization Requirements

Despite its rapid growth, the B2B e-commerce market faces the restraint of complex pricing models and customization demands, which can be difficult to translate into a standardized digital format. Unlike B2C markets where prices are fixed and public, B2B transactions often involve volume-based pricing, negotiated contracts, buyer-specific discounts, and long payment cycles.

For example, an industrial supplier might offer a custom quote for 1,000 units of a product depending on the client’s region, historical order volume, and payment terms. These nuanced relationships can be difficult to replicate in an off-the-shelf e-commerce platform without significant customization.

Additionally, large-scale buyers often request bespoke features such as API integrations, logistics handling, packaging customization, and compliance documentation complicating the transaction process. This complexity can deter smaller suppliers from adopting B2B e-commerce due to perceived costs and integration challenges.

Key Market Opportunity: Expansion into Emerging Markets and SMEs

A major opportunity for the B2B e-commerce sector lies in its expansion into emerging markets and onboarding of small and medium-sized enterprises (SMEs). While B2B e-commerce is well established in developed economies like the U.S., China, and Germany, regions in Latin America, Southeast Asia, and Africa remain largely untapped.

Furthermore, SMEs in these regions often lack direct access to large buyers or global supply chains. B2B platforms serve as a digital gateway, enabling them to market their products globally without investing in physical storefronts or expensive sales teams.

Initiatives like Alibaba’s “Go Global” SME program and Amazon’s global selling campaigns illustrate the potential of bringing SMEs into the global B2B fold. With increasing internet penetration, mobile commerce, and cloud-based SaaS tools, the barriers to entry are reducing, presenting a massive growth lever for platform operators and enablers alike.

Segments Insights

By Product Category

Industrial & Science products dominate the B2B e-commerce market, due to the sheer volume and frequency of procurement in this sector. Manufacturers and construction firms rely heavily on platforms to procure raw materials, machine parts, industrial chemicals, tools, and safety gear. These are high-value transactions often executed under time-sensitive constraints, making digital procurement a reliable alternative to traditional vendor management. Platforms like ThomasNet and Alibaba have built entire ecosystems around this category, offering real-time availability, pricing, and bulk negotiation features.

Healthcare is the fastest-growing product segment, driven by the digitalization of hospital procurement, telemedicine infrastructure, and urgent sourcing needs highlighted during the COVID-19 pandemic. From PPE to diagnostic devices, healthcare institutions are now using B2B platforms to access certified suppliers globally. Moreover, subscription-based procurement of consumables such as gloves, syringes, and testing kits has been enabled through automated reordering systems, boosting demand for integrated healthcare B2B platforms.

By Deployment

Supplier-oriented platforms dominate the deployment landscape, where large manufacturers or distributors build proprietary e-commerce portals to sell directly to buyers. This model offers better control over pricing, branding, and customer experience. Companies like GE, Grainger, and Honeywell operate such portals, integrating them with their CRM and ERP systems to provide personalized quotes and support for their clients.

Intermediary-oriented platforms are the fastest-growing, particularly in fragmented industries where buyers seek transparency and choice. These platforms act as a digital marketplace, aggregating listings from various sellers and simplifying comparisons. Players like Amazon Business and IndiaMART are thriving in this space by offering a neutral, scalable environment for both sides of the transaction.

Regional Analysis

Asia-Pacific leads the global B2B e-commerce market, with countries like China, Japan, and South Korea showing high maturity levels in B2B digitization. Alibaba’s dominance in China is a key factor, enabling millions of businesses—both buyers and sellers—to transact with speed and efficiency. China’s infrastructure, mobile penetration, and logistics efficiency have enabled rapid digitization even in rural areas. Additionally, government-backed digital trade initiatives have further stimulated B2B commerce.

Africa is the fastest-growing region, although it starts from a smaller base. The proliferation of mobile phones, fintech platforms, and logistics startups is enabling a wave of digital procurement innovation. Platforms like Wasoko and TradeDepot are transforming how retailers source products, particularly in fast-moving consumer goods (FMCG). Support from NGOs and global venture capital has accelerated digital infrastructure in African economies, creating favorable conditions for B2B e-commerce expansion.

Recent Developments

-

April 2025 – Amazon Business announced the expansion of its B2B marketplace services in Southeast Asia, targeting enterprise procurement in Indonesia and Vietnam with localized offerings.

-

March 2025 – Alibaba launched an AI-driven analytics engine to support demand forecasting and supply chain resilience for global B2B sellers.

-

February 2025 – SAP Ariba integrated generative AI tools into its procurement platform to enable conversational ordering and contract drafting.

-

January 2025 – IndiaMART acquired a cloud-based logistics platform to provide last-mile delivery services for B2B shipments across Indian Tier 2 and Tier 3 cities.

-

December 2024 – ThomasNet rebranded as Thomas IQ, focusing on industrial intelligence services integrated with its B2B procurement portal.

Key Business-to-Business E-commerce Companies:

The following are the leading companies in the business-to-business e-commerce market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these B2B e-commerce companies are analyzed to map the supply network.

- Amazon.com, Inc.

- Alibaba.com

- ASOS

- Costco Wholesale Corporation

- Dangdang

- eBay Inc.

- Flipkart.com

- JD.com

- Lazada

- MercadoLibre S.R.L.

- Shopify

- Shopee

- Walmart

- Wayfair LLC

- Zalando

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Business-to-Business E-commerce market.

By Product Category

- Home & Kitchen

- Consumer Electronics

- Industrial & Science

- Healthcare

- Clothing

- Beauty & Personal Care

- Sports Apparel

- Books & Stationery

- Automotive

- Others

By Deployment

- Supplier-oriented

- Buyer-oriented

- Intermediary-oriented

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)